Intraday Call Provider

Intraday Call Providers offer real-time trading recommendations for buying and selling securities. These services help traders make quick investment decisions to capitalize on short-term market movements.

By providing timely and accurate analysis, they aim to help traders maximize their profits and minimize risks. Intraday call providers play a crucial role in the fast-paced world of stock trading, offering valuable insights and recommendations for short-term trading. Their real-time analysis and expert advice enable traders to identify profitable opportunities and execute timely trades.

In this competitive and dynamic market environment, having access to reliable intraday calls can make a significant difference in trading success. Whether it’s stocks, commodities, or forex, these providers empower traders with the information they need to make informed decisions and navigate the complexities of intraday trading effectively. With their assistance, traders can stay ahead of market trends and make the most of intraday trading opportunities. Overall, the expertise and recommendations provided by intraday call providers are invaluable resources for traders seeking to optimize their short-term investment strategies.

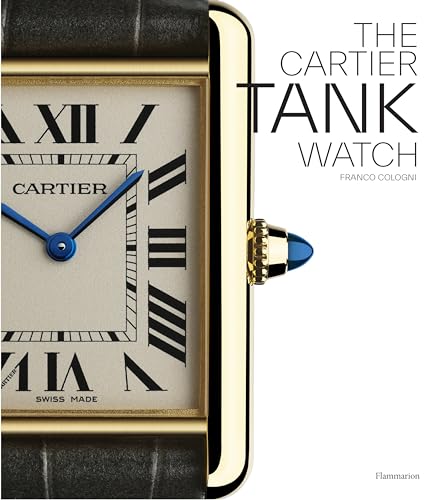

Credit: www.facebook.com

What Is An Intraday Call Provider?

An intraday call provider is a financial service that offers traders real-time recommendations for buying and selling stocks, commodities, or currencies within the same trading day. This service is particularly valuable for active traders and investors who seek to capitalize on short-term price movements.

Definition

An intraday call provider, also known as a day trading call provider, is an entity or platform that delivers calls or tips for executing trades within the same trading day. These calls are based on technical and fundamental analysis, aiming to exploit short-term price fluctuations.

Importance

The role of an intraday call provider is crucial for day traders, as it assists in making quick and informed decisions based on real-time market conditions. By providing timely recommendations, it helps traders to seize profitable opportunities and mitigate potential risks within a short timeframe.

Credit: www.linkedin.com

How Do Intraday Call Providers Work?

To understand how Intraday Call Providers work, it’s essential to delve into the mechanisms that drive their operations. Intraday Call Providers use a combination of data analysis, technical indicators, and market trends to offer timely and accurate trading recommendations to their clients.

Data Analysis

Data analysis forms the backbone of Intraday Call Providers’ operations. They meticulously study and interpret various market data, including stock prices, trading volumes, and historical patterns, to identify potential opportunities for intraday trading. By leveraging advanced analytical tools and techniques, these providers are adept at spotting trends and patterns that may indicate potential price movements.

Technical Indicators

Technical indicators play a crucial role in guiding the trading decisions of Intraday Call Providers. These indicators, such as moving averages, relative strength index (RSI), and stochastic oscillators, provide valuable insights into the momentum and volatility of a particular stock or market. Intraday Call Providers rely on these indicators to gauge the strength of price movements and identify entry and exit points for their recommendations.

Market Trends

Keeping a pulse on market trends is fundamental to the success of Intraday Call Providers. They closely monitor macroeconomic factors, industry news, and geopolitical events that could impact the financial markets. By staying attuned to these trends, providers can assess the potential impact on stock prices and adjust their intraday calls accordingly, ensuring that their clients are well-informed and positioned to capitalize on emerging opportunities.

Benefits Of Using Intraday Call Providers

Discover the benefits of using Intraday Call Providers and take advantage of their insightful recommendations for profitable day trading. Gain an edge in the market with expert analysis and real-time information, increasing your chances of making successful trades.

There are several benefits that traders can enjoy when using Intraday Call Providers. From accurate predictions to time-saving features, these platforms are designed to help maximize profits and ensure successful trades.

Accurate Predictions

One of the key advantages of using Intraday Call Providers is the ability to receive accurate predictions for stock market movements. These providers utilize advanced algorithms and technical analysis to generate precise recommendations. This ensures that traders have access to reliable and timely information to make informed trading decisions.

Time-saving

By utilizing Intraday Call Providers, traders can save valuable time and effort in conducting their own market research. These platforms provide ready-made analysis and recommendations, allowing traders to focus on executing their strategies rather than spending hours analyzing the market. This time-saving aspect is particularly beneficial for busy professionals or those who want to actively trade while managing other responsibilities.

Maximizing Profits

Another significant benefit of using Intraday Call Providers is the potential to maximize profits. These platforms deliver real-time alerts and insights, enabling traders to capitalize on short-term market movements and potential profit opportunities. By leveraging the accurate predictions and guidance provided by these providers, traders can make more informed decisions to optimize their profits.

In conclusion, Intraday Call Providers offer a range of benefits to traders, including accurate predictions, time-saving features, and the potential to maximize profits. By utilizing these platforms, traders can gain a competitive edge and enhance their trading strategies in the fast-paced world of intraday trading.

Choosing The Right Intraday Call Provider

When it comes to intraday trading, having the right information at the right time can make all the difference in your success. Intraday call providers offer a valuable service by offering accurate and timely investment recommendations to traders. But with so many providers out there, how do you choose the right one for your needs? In this article, we will explore key factors to consider when selecting an intraday call provider.

Reputation

One of the first things to consider when choosing an intraday call provider is their reputation in the industry. A reputable provider will have a track record of success and a strong customer base. They will be known for their accurate calls and reliable service. Look for providers that have been operating for several years and have a high customer retention rate. This indicates that they have built a trust and credibility in the market.

Track Record

The track record of an intraday call provider is another important factor to consider. Review their past performance to see how accurate their calls have been. Look for providers that consistently deliver profitable recommendations and have minimal instances of false or misleading calls. This information can usually be found on their website or through third-party platforms. A provider with a strong track record is more likely to provide you with reliable and profitable intraday calls.

Customer Reviews

Customer reviews can provide valuable insights into the quality of service provided by an intraday call provider. Look for reviews and testimonials from actual customers who have used their services. Pay attention to the overall satisfaction level, the accuracy of the calls, and the level of customer support. Providers with positive reviews and high customer satisfaction are more likely to meet your expectations and deliver quality recommendations.

In conclusion, when choosing an intraday call provider, it is essential to consider their reputation, track record, and customer reviews. By doing thorough research and evaluating these factors, you can find a provider that suits your trading style and helps you achieve your investment goals.

Key Considerations For Intraday Trading

Intraday trading can be a highly rewarding venture, but it also comes with its fair share of risks and challenges. To navigate this fast-paced market successfully, it is vital to consider key factors that can impact your trading decisions. In this blog post, we will discuss three important considerations for intraday trading: risk management, trading strategies, and market volatility.

Risk Management

Effective risk management is crucial in intraday trading to protect your capital from potential losses. By implementing a well-defined risk management plan, you can minimize the impact of individual losing trades and maintain long-term profitability.

Consider the following risk management strategies:

- Set a stop-loss order to limit potential losses if the market moves against your position.

- Determine your risk tolerance and adjust your position size accordingly.

- Regularly review your trades and learn from both the wins and losses.

- Keep emotions in check and avoid impulsive trading decisions.

Trading Strategies

Having a well-thought-out trading strategy in place is essential for intraday trading success. Your strategy should consider various aspects, such as entry and exit points, timeframes, and indicators. Here are a few popular intraday trading strategies:

- Breakout Trading: Identify price levels where the market is likely to break out and make significant moves. Enter trades when price breaks above resistance or below support levels.

- Trend Trading: Follow the direction of the prevailing market trend and enter trades in alignment with the trend’s momentum.

- Range Trading: Identify price ranges in which the market is trading and enter trades near support or resistance levels within the range.

Market Volatility

Market volatility refers to the speed and magnitude of price movements in the market. Intraday traders often seek volatile markets that offer more significant profit potential. However, high volatility also increases the risk of losses. Consider the following when trading in volatile markets:

- Stay updated on market news and events that can impact price movements.

- Monitor the volatility indicators for the assets you are trading.

- Adjust your trading strategy and risk management approach according to the current market conditions.

By taking these key considerations into account, you can enhance your intraday trading performance, minimize risks, and increase your chances of achieving consistent profits in this dynamic market.

Credit: in.pinterest.com

Frequently Asked Questions Of Intraday Call Provider

Which Is The Best Intraday Tips Provider?

The best intraday tips provider offers accurate and reliable trading guidance for quick earnings. Conduct thorough research and choose a provider with a strong track record and positive reviews. Stay updated with market trends and consult with experienced traders for recommendations.

Which Company Is Best For Intraday?

The best intraday company depends on your trading style and needs. Consider popular options like Zerodha, Upstox, and Angel Broking for their low fees and user-friendly platforms. Do your research to find the best fit for you.

Does Zerodha Provide Intraday Calls?

Yes, Zerodha provides intraday calls for trading. They offer recommendations and tips for buying and selling stocks within the same trading day. Intraday calls can help traders capitalize on short-term price movements and make quick profits.

Which Broker Is Best For Intraday?

The best broker for intraday trading depends on your specific needs and preferences. Some popular options include TD Ameritrade, Interactive Brokers, and E*TRADE. Evaluate features like trading platform, fees, and customer support to find the one that suits you best.

Conclusion

Utilizing a reliable intraday call provider can greatly benefit traders in the fast-paced world of stock market trading. By providing timely and accurate information, these providers empower traders to make informed decisions and maximize their profits. With their expert analysis and real-time updates, intraday call providers offer a valuable resource for both experienced and novice traders alike.

So, make the most of this opportunity and stay ahead of the game with an intraday call provider by your side.