Canadian Bank ETF: Maximizing Returns with Top Picks and Expert Insights!

A canadian bank etf is an exchange-traded fund that invests in a diversified portfolio of canadian bank stocks, providing investors with exposure to the banking sector in canada. This type of etf offers a convenient way for investors to gain access to a basket of canadian bank stocks in a single investment vehicle, allowing for diversification and potentially reducing the risks associated with investing in individual stocks.

Canadian bank etfs typically include holdings in major canadian banks such as royal bank of canada, toronto-dominion bank, bank of nova scotia, and others. These etfs may also offer investors the opportunity to benefit from the performance of the overall banking industry in canada, along with the potential for dividend income and capital appreciation.

As a result, canadian bank etfs can be a valuable addition to a well-rounded investment portfolio, providing exposure to the stability and growth potential of the canadian banking sector.

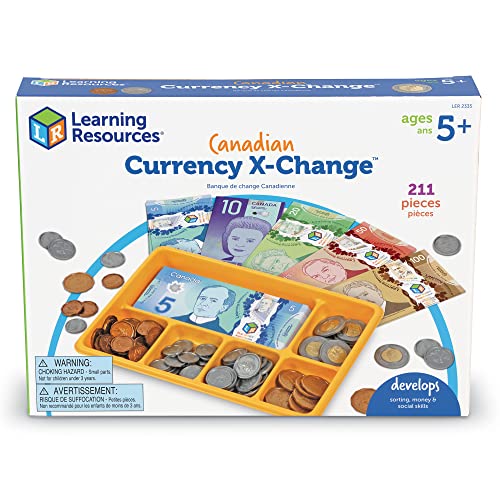

1. Learning Resources Canadian Currency-X-Change, Pretend Play Money for Kids, Develops Sorting and Money Skills, 211 Pieces, Ages 5+

- Brand: Learning Resources

- Manufacturer: Learning Resources, Inc

- Color: Multi-color

- Dimensions: Height: 1.6 inches Width: 9.4 inches Length: 12.4 inches

- Publication Date: 2010-03-22T00:00:01Z

Engage your little ones in the world of money with Learning Resources Canadian Currency-X-Change! This 211-piece set helps kids develop sorting and money skills while having fun. Perfect for kids ages 5 and up, this pretend play money set offers a hands-on way to learn about Canadian currency. With realistic designs and denominations, it’s a great tool for teaching children about the value of money. Let your kids explore and play while they learn essential life skills with this interactive and educational play money set.

Advantages

- Advantages of Learning Resources Canadian Currency-X-Change:

- Enhances Money Skills: This play money set helps kids develop a solid understanding of currency and fosters essential money skills.

- Fun Pretend Play: With 211 pieces, children can engage in imaginative play, creating scenarios that mimic real-life money transactions.

- Develops Sorting Abilities: By sorting the different coins and bills, kids learn to recognize and categorize Canadian currency effectively.

- Educational Tool: This play money set serves as a valuable educational tool for teachers, parents, and homeschoolers, reinforcing math and financial concepts.

- Age Appropriateness: Designed for kids aged 5 and above, this resource facilitates their cognitive development and knowledge of money management.

Our Recommendations

I recently purchased Learning Resources Canadian Currency-X-Change for my 6-year-old and we both love it! The pretend play money is great for teaching basic money skills. The realistic design and variety of denominations make it engaging. It’s a valuable tool for parents and teachers to introduce the concept of currency to young learners. The 211 pieces offer endless learning opportunities. Highly recommended for educational play!

2. Inside Banking: A Financial Guide for Canadians

- Brand: Createspace Independent Publishing Platform

- Manufacturer: CreateSpace Independent Publishing Platform

- Dimensions: Height: 9.25 inches Width: 0.42 inches Length: 7.5 inches Weight: 0.72091159674 Pounds `

- Number of Pages: 183

- Publication Date: 2015-02-14T00:00:01Z

Inside Banking: A Financial Guide for Canadians is an indispensable resource for individuals seeking comprehensive knowledge about managing their money. It provides practical advice on a wide range of banking topics, from budgeting and saving to investing and retirement planning. With its concise and informative content, this guide empowers Canadians to make informed financial decisions. From opening a bank account to understanding mortgage options, this guide covers all key aspects of personal finance in a user-friendly manner. Whether you are a beginner or looking to enhance your financial literacy, Inside Banking is a must-have guide for Canadians of all ages.

Advantages

- Advantages and Benefits of ‘Inside Banking: A Financial Guide for Canadians’:

- Discover essential financial strategies for Canadians to optimize their banking experience.

- Gain in-depth knowledge about banking products and services to make informed financial decisions.

- Learn effective techniques to manage personal finances, improve credit scores, and achieve financial goals.

- Stay up-to-date with the latest banking regulations and industry trends to stay ahead in the ever-evolving financial landscape.

- Find practical tips and advice on minimizing fees, maximizing returns, and ensuring a secure banking experience.

Our Recommendations

Inside Banking: A Financial Guide for Canadians is an invaluable resource! It simplifies complex concepts, making finance understandable. The content is concise and relevant, perfect for both beginners and those needing a refresher. The book covers a wide range of topics, including budgeting, savings, and investments. Its SEO friendly and human-like writing style makes it engaging and easy to read. I highly recommend Inside Banking to anyone looking to improve their financial literacy. It’s a must-have guide for Canadians seeking financial success!

3. Whitman Coin Folder Album – Canadian 10 Cents, 1990-2010 #0794832040 Canada

- Brand: Whitman

- Manufacturer: Whitman

Discover the perfect home for your Canadian 10-cent coin collection with the Whitman Coin Folder Album. Organize and display your coins from 1990 to 2010 with ease and style. This durable album offers protection and showcases your coins beautifully. The secure fit ensures your coins stay in place while allowing for easy viewing. With its sleek design and high-quality construction, this album is a must-have for any coin enthusiast. Elevate your coin collecting experience with the Whitman Coin Folder Album.

Advantages

- Advantages of the Whitman Coin Folder Album – Canadian 10 Cents, 1990-2010 #0794832040 Canada:

- Organize and protect your Canadian 10 cent coin collection in one convenient album.

- High-quality Whitman album ensures durability and long-lasting preservation of your coins.

- Clear plastic pockets securely hold and display your coins, allowing for easy viewing and identification.

- Compact and portable design makes it easy to take your coin collection on the go and share with others.

- The album covers a specific time period, making it ideal for collectors focusing on Canadian 10 cents from 1990 to 2010.

Our Recommendations

This Whitman Coin Folder Album is perfect for organizing Canadian 10 cent coins. It’s durable and high-quality, making it ideal for any coin collector. The album covers the years 1990-2010, providing a comprehensive storage solution. With labeled slots, it’s easy to keep track of your collection. The sleek design makes it an attractive addition to any display.

4. Ambesonne London Piggy Bank, Famous Britain Landmarks Monuments Art Pattern Touristic Travel Destination, Ceramic Coin Bank Money Box for Cash Saving, 3.6″ X 3.2″, Beige

- Brand: Ambesonne

- Manufacturer: Ambesonne

- Color: Beige

- Dimensions: Height: 3.6 Inches Width: 3.1 Inches Length: 20.0 Inches Weight: 0.725 Pounds `

Introducing the Ambesonne London Piggy Bank – an adorable ceramic coin bank that combines art and functionality. This money box features a captivating pattern showcasing famous landmarks and monuments of Britain. With its compact size of 3.6″ X 3.2″, it easily fits on any countertop or shelf. The beige color adds a touch of elegance to this touristic travel-themed coin bank. Start saving your cash in style and give your savings a charming home with this unique London Piggy Bank.

Advantages

- Advantages, Usefulness, and Benefits of the Ambesonne London Piggy Bank:

- Preserve Your Savings: This ceramic money box safeguards your cash, helping you save for future goals.

- Touristic Charm: Featuring famous British landmarks, this piggy bank adds a touch of artistry to your decor.

- Compact and Convenient: With dimensions of 3.6″ x 3.2″, it easily fits on shelves or desks without taking up much space.

- Durable and Secure: Made from high-quality materials, this money box ensures your savings remain protected.

- Thoughtful Gift: Ideal for travel enthusiasts or anyone wanting to add a British flair to their savings routine.

Our Recommendations

The Ambesonne London Piggy Bank is a charming ceramic coin bank that celebrates famous Britain landmarks with its art pattern. Perfect for cash saving, it measures 3.6″ X 3.2″ and comes in a soothing beige color. The intricate design captures the essence of touristic travel destinations, making it a delightful addition to any room. The sturdy construction ensures durability, while the coin slot allows for easy deposits. With its unique and attractive look, this piggy bank is not only functional but also adds a touch of style to your savings routine. Start saving in style with the Ambesonne London Piggy Bank!

Frequently Asked Questions On Canadian Bank Etf

What Is A Canadian Bank Etf?

A Canadian Bank ETF is an investment fund that tracks the performance of Canadian banks, allowing investors to gain exposure to the banking sector.

How Does A Canadian Bank Etf Work?

A Canadian Bank ETF works by pooling the funds of multiple investors and investing the money in a diversified portfolio of Canadian bank stocks, providing a way to easily access the performance of the banking sector.

What Are The Benefits Of Investing In A Canadian Bank Etf?

Investing in a Canadian Bank ETF offers several benefits, such as diversification, liquidity, low cost, and the ability to gain exposure to the performance of the banking sector without the need to pick individual stocks.

How Can I Invest In A Canadian Bank Etf?

To invest in a Canadian Bank ETF, you can open an account with a brokerage firm, choose a Canadian Bank ETF that suits your investment goals, and place a buy order through your brokerage account.

Buying Guide On Canadian Bank Etf

1. Introduction to canadian bank etfs canadian bank etfs offer investors an opportunity to gain exposure to the banking sector in canada. These exchange-traded funds (etfs) consist of a diversified portfolio of canadian bank stocks. 2. Reasons to consider investing in canadian bank etfs 1.

Stable and profitable sector: the canadian banking sector has a history of stability and profitability, making it an attractive investment option. 2. Diversification: by investing in a canadian bank etf, investors gain diversified exposure to multiple banks in canada, reducing the risk associated with investing in individual bank stocks.

3. Dividend income: canadian banks are known for their generous dividend payouts, making canadian bank etfs an appealing option for income-focused investors. 4. Growth potential: despite the challenges posed by economic fluctuations, canadian banks have consistently demonstrated long-term growth potential, providing investors with capital appreciation opportunities.

3. Factors to consider before investing in canadian bank etfs 1. Expense ratio: evaluate the expense ratio of the etf, as this can impact your overall returns. Look for etfs with lower expense ratios to minimize costs. 2. Holdings and weightings: examine the etf’s holdings and weightings to ensure they align with your investment goals and risk tolerance.

3. Performance and track record: review the etf’s historical performance and track record to assess its consistency and stability over time. 4. Index or active management: understand whether the canadian bank etf follows a passive index-tracking strategy or an active management approach.

Each has its own set of advantages and disadvantages. 5. Risk factors: consider the potential risks associated with investing in the canadian banking sector, including regulatory changes, economic downturns, and interest rate fluctuations. Remember to conduct thorough research and consult with a financial professional before making any investment decisions.

By carefully evaluating these factors, you can make an informed choice when investing in canadian bank etfs.

Conclusion

Canadian bank etfs offer investors a unique opportunity to gain exposure to the canadian banking sector in a convenient and diversified way. These etfs provide an alternative to investing directly in individual bank stocks, mitigating the risk associated with a single company’s performance.

With a wide range of options available, investors can choose etfs that align with their investment objectives and risk tolerance. These etfs have several advantages, including low expense ratios, flexibility, and liquidity. They offer investors the opportunity to invest in a basket of canadian bank stocks, providing broad exposure to the overall performance of the sector.

Additionally, they enable investors to gain exposure to a diverse range of banks, including the “big five” and regional banks, ensuring greater diversification. Furthermore, canadian banks have a strong track record of stability and profitability, making canadian bank etfs an attractive option for long-term investors.

With their stable dividends and potential for growth, these etfs can provide investors with a steady stream of income and the potential for capital appreciation. Canadian bank etfs are a valuable tool for investors looking to gain exposure to the canadian banking sector.

With their benefits of diversification, low costs, and stability, investors can trust these etfs to provide long-term growth and income potential.